Introduction

Explore the world of options trading and 해외선물 enhance your investment strategies with our comprehensive guide on options spreads. Our insightful techniques will provide valuable knowledge to optimize your investment returns. Join us to unravel the intricacies of options spreads, and master the art of trading.

Understanding Options Spreads

To start off, let’s define options spreads. 선물옵션 It involves carefully combining the purchase and sale of options contracts with divergent strike prices and expiration dates. Employing this method enables investors to profit from different market circumstances while keeping risks controlled. Now that we have a clear understanding, let’s delve into the details.

The Basics of Options Spreads

Options spread rely on long and 해외선물커뮤니티 short positions, where the former involves buying options contracts and the latter entails selling them. This strategic combination allows investors to pursue diverse investment objectives.

Types of Options Spreads

There are several types of options spreads, each with its own unique characteristics and potential benefits. Let’s explore some of the most common ones:

Vertical Spreads: Investors can take 해외선물대여계좌 advantage of price movements within a specific range through vertical spreads. With this strategy, options contracts with different strike prices but the same expiration date are bought and sold. This offers a clear and concise approach to capitalizing on these opportunities.

Horizontal Spreads: Unlike vertical spreads, horizontal spreads use options contracts with identical strike prices but varying expiration dates. This approach seeks to capitalize on market fluctuations as they evolve over time.

Diagonal Spreads: Increase your profit potential and flexibility with diagonal spreads – the perfect combination of vertical and horizontal spreads. By utilizing options contracts with varying strike prices and expiration dates, this strategy provides investors with a wider range of potential profits. Optimize your investment portfolio and enhance your financial success with diagonal spreads.

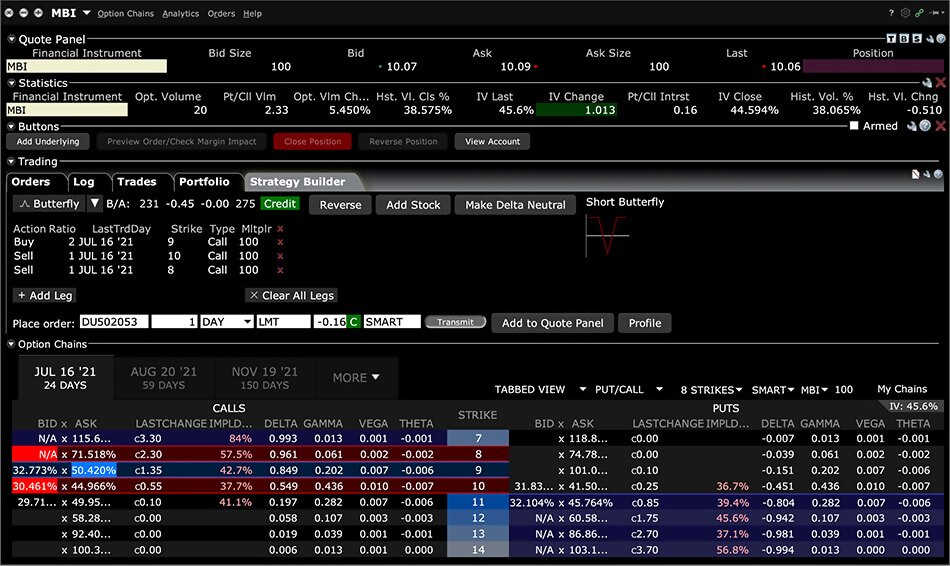

Butterfly Spreads: Create a balanced profit 해선커뮤니티 and loss approach with butterfly spreads. Merge different options contracts with varying strike prices to produce symmetric results. This strategy is advantageous for investors who foresee limited price fluctuations.

Calendar Spreads: Maximizing option premium profits through time decay is the primary goal of calendar spreads, also referred to as time spreads. Options contracts with identical strike prices but varying expiration dates are utilized in this methodical approach.

Benefits of Options Spreads

Now that we have a solid understanding of options spreads, let’s delve into the benefits they offer to investors like you.

Risk Management

Investors can manage risk more effectively 해선대여계좌 through the use of options spreads, which combine long and short positions. This strategy limits potential losses while still allowing participation in the market, making it especially useful during volatile market conditions. Discover the benefits of this risk mitigation technique today.

Enhanced Profit Potential

Investors seeking to maximize their returns can explore the exciting world of options spreads. With strategic combinations of buying and selling options contracts, these investment tools offer a flexible approach that can be tailored to fit your market outlook and risk threshold. Experience the potential for enhanced profit in a more customized way with options spreads.

Diversification

Investors can benefit from diversification with options spreads. By utilizing various types of spreads, adjusting strike prices, and expiration dates, they can distribute their risk across multiple positions. This approach reduces the impact of sudden market changes on overall investment performance, making it an effective strategy.

Income Generation

Investors seeking steady income should look no further than credit spreads. This option spreads offer lucrative premiums from options contracts sold and provide a conservative approach to cash flow generation. Discover how this strategy can benefit your investment portfolio.

Conclusion 해외선물사이트

To excel in investing, mastering the skill of options spreads is crucial. These strategies can aid in achieving financial objectives by enhancing investment tactics. You can enhance your returns and manage risks by comprehending the diverse spreads and their advantages. It is essential to remember that options trading involves risks that should not be overlooked. Before delving into such activities, it is imperative to learn thoroughly, and professional guidance must be sought.